A paper published by researchers from the New York University Polytechnic School of Engineering provides insight into the world of bitcoin mining and reveals the reason why many bitcoin miners struggle to break even.

The authors, Luqin Wang and Yong Liu, collected data on the bitcoin blockchain from 2009/01/03 (the creation date of the genesis block) to 2014/03/11, which included 290,089 blocks and 34,646,076 transactions.

Changes in mining over the years

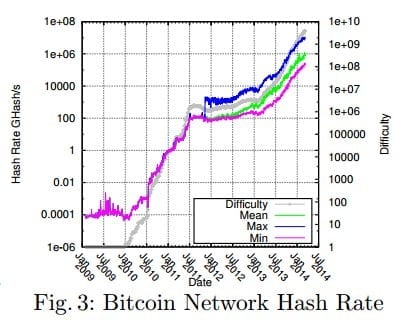

They found that earlier on, miners had an evenly distributed hashrate. However, as time went on, a number of miners – mining pools – went on to amass a very large hashrate.

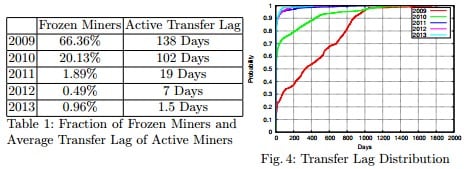

The authors also looked at the length of time it took for mined bitcoins to be transferred to another address. They found that 66.36% of miners in 2009 have still not yet used their funds. The average time it took for mined bitcoins to be sent was 138 days.

On the contrary, only 0.96% of miners in 2013 left their bitcoins in their original addresses. They also made transactions with their bitcoins earlier, taking an average of only one and a half days.

This change suggests that earlier bitcoin users may not taken mining seriously enough to keep their earnings. They may also have lost the private keys to access them. On the other hand, mining has become a competitive business in recent years, so it would make sense for miners to spend or sell their bitcoins.

Another fact to take into consideration is that the bitcoin price surged from practically zero during 2009 to a peak of $1250 in 2013. This increase in value likely led to miners to consider the activity as a means of generating profit.

A closer look at F2Pool

The authors, Luqin Wang and Yong Liu, took a close look at F2Pool, one of the world’s largest bitcoin mining pools by hashrate. It was previously known as “Discus Fish” and is based in China. At the time of writing, the pool had a total hashrate of 62.5 Phash/s.

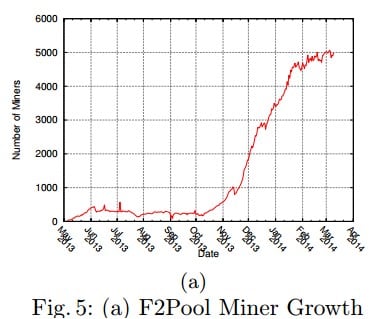

They found that the number of miners on F2Pool from mid to late 2013 was relatively stable. This corresponded with the bitcoin price staying at roughly $120. The pool’s miner count grew at a fast pace near the end of the year.

By April 2014, the pool had accumulated roughly 5,000 miners, compared to roughly 1,000 during November 2013.

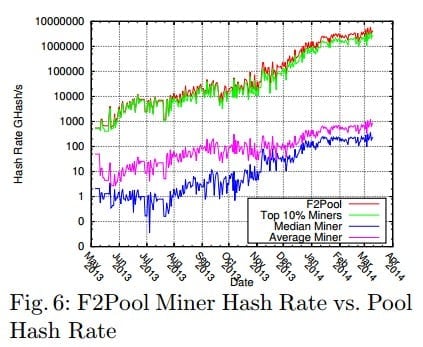

The paper shows that the pool’s top 10% miners made up most of its hashrate. They were able to make a significantly larger contribution compared to the median and average miners.

Older hardware means lower profits

The paper’s authors did not only look at the growth of the mining industry; they also analyzed the potential financial gains or losses experienced by bitcoin miners.

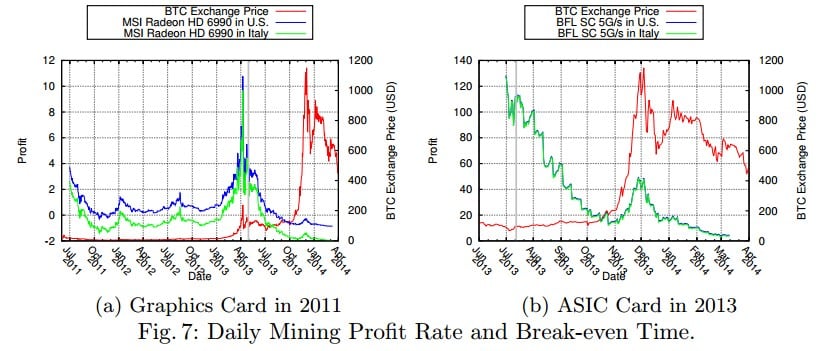

They compared two pieces of hardware which could be used for mining: a MSI Radeon HD 6990 graphics card capable of mining at roughly 750 Mh/s, and a Butterfly Labs SC 10Gh/s ASIC miner. The researchers also took into account the electricity used by the devices, as well as the cost to purchase them.

They found that if a person started mining with the Radeon graphics card in 2011, he/she would make back the original investment in April 2013. From there, the graphics card would generate profits for the owner until September 2013, when the difficulty rise to a point that would make running the card unprofitable.

This calculation assumes that the miner paid $0.0933/kWh (the average price of electricity in the United States). If the miner was located in Italy where the typical cost would be $0.2056/kWh, almost double the price, he/she would not be able to turn a profit.

Despite the high cost of electricity in Italy, the paper shows that the 10Gh/s ASIC miner produced by Butterfly Labs would have created a return on investment in less than a month. This applies not only to Italy, but also to the United States, as well as other countries such as Belgium, Sweden, and the United Kingdom.

The finding is evidence that it is difficult for miners to earn a profit, especially when they are competing against others with faster and more energy-efficient hardware. Their competitors may also have the advantage of lower electricity costs.

The paper concluded that competition involved in bitcoin mining has increased sharply over the years. It shows that it is not financially feasible for miners to continue unless they keep up with modern mining hardware.