Although the official report is yet to be released, it appears that when Mt. Gox closed, many investors may have lost millions of dollars but the report in question states that the virtual currency may already have been long gone.

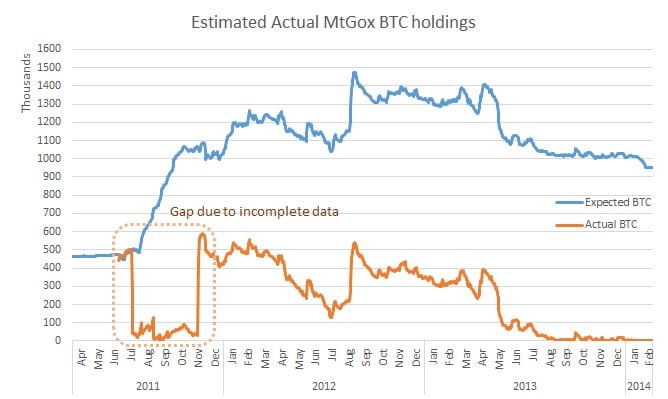

Worth over $300 million at the time’s trading rates, Mt. Gox’s former Bitcoin reserves are under the microscope being investigated by WizSec. Lead investigator, Kim Nilsson, reports that funds were actually taken from the reserves from as early as late 2011 onwards. The security specialist firm claims that most or all of the currency were stolen over time and finally being totally depleted by 2013.

The executive summary states:

Most or all of the missing Bitcoins were stolen straight out of the MtGox hot wallet over time, beginning in late 2011. As a result, Mt. Gox operated at fractional reserve for years (knowingly or not), and was practically depleted of Bitcoins by 2013. A significant number of stolen Bitcoins were deposited onto various exchanges, including MtGox itself, and probably sold for cash (which at the Bitcoin prices of the day would have been substantially less than the hundreds of millions of dollars they were worth at the time of Mt. Gox’s collapse).

In February 2014, Mt. Gox closed its doors leaving investors at a loss, and the company filing for bankruptcy in both the US and Japan stating the closure was due to “weaknesses in the system”.

Now rumors are surfacing that the theft of the digital currency was an inside job. Investigators are now looking for ties between Mt. Gox and the former online black market, Silk Road. If these allegations are found to be true it would prove to be a disastrous hit to Bitcoin overall. Another unsubstantiated theory has surfaced that Mt. Gox was selling off the Bitcoins to continue operations of the exchange program meaning the company was operating nothing more than a pyramid scheme.

Many people believe that the Mt. Gox automated Bitcoin bulk buying bot, named “Willy”, was connected to the theft but WizSec does not believe this to be the case. By the time “Willy” was implemented, most of the reserve was already gone.

What the report does state is that there were a number of discrepancies in recorded holdings after 2011 with transactions obviously taking place but with no clear log entries to record the transaction.

“. . . if we look closely,” says WizSec, “this discrepancy seems to be growing over time. By the middle of 2013, there are practically no Bitcoins left at all. ”

At this time the company is unwilling to release the data while they continue to work with investigators.