Since before the 1929 crash, market crash prediction has been the golden ticket for market participants. In a recent paper, Jonathon Donier and Jean-Philippe Bouchaud of Paris’ Capital Fund Management show progress in crash prediction. Their advances were made possible thanks to Bitcoin market immaturity.

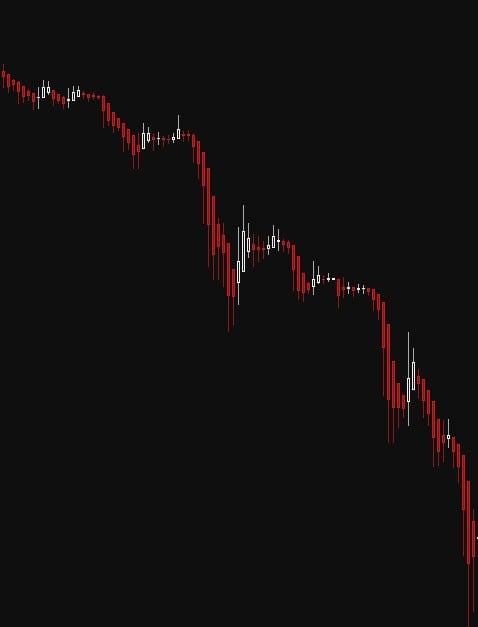

Initially purposed a few years ago, Donier and Bouchaud were able to improve the formula. On most Bitcoin markets, order books are public with many users preemptively setting long term orders. Using only public data, Donier and Bouchaud show a dynamic evaluation of liquidity risk and market instabilities. These evaluations very accurately predicted sizes of the largest 14 single-day Bitcoin crashes between January and April 2013.

For more mature markets with hidden order books or common order book manipulation, Donier and Bouchaud looked for a decline of buy demand. Their results were very similar to results from a simpler formula; market volatility divided by the square root of volume.

Despite these remarkable results, the formula is only able to show the likelihood of a crash. When the crash will occur or if it happens at all, lie with other market influences. On this subject, Donier and Bouchaud explain, “Still, our analysis motivates better dynamical risk evaluations (like value-at-risk), impact adjusted marked-to-market accounting or liquidity-sensitive option valuation models.”

Donier and Bouchaud would next like to participate in a study of correlation between realized crash probability and their simplified formula on a larger domain of stocks.